Quantum technologies encompass computing, communication, and sensing, with quantum computing playing a pivotal role in simulation, optimization, and AI. While research and development efforts and investments predominantly target quantum computing, there is a growing interest in quantum networking and ultra-sensitive sensors.

Eric Mounier, Ph.D., chief analyst, Photonics & Sensing at Yole Group, said “Forecasts anticipate significant growth in quantum computing hardware and QaaS , reaching $438 million and $528 million, respectively, by 2029. Quantum communication, propelled by QKD and QRNG, is projected to expand its market to $249 million by the same year. Despite its niche status, quantum sensing offers precise measurement capabilities across various parameters, with a projected market value of $617 million by 2029.”

Overall, the total quantum market is expected to reach $1,832 million by 2029, with quantum computing poised to dominate post-2030, reaching $3,324 million by 2034, driven primarily by QaaS.

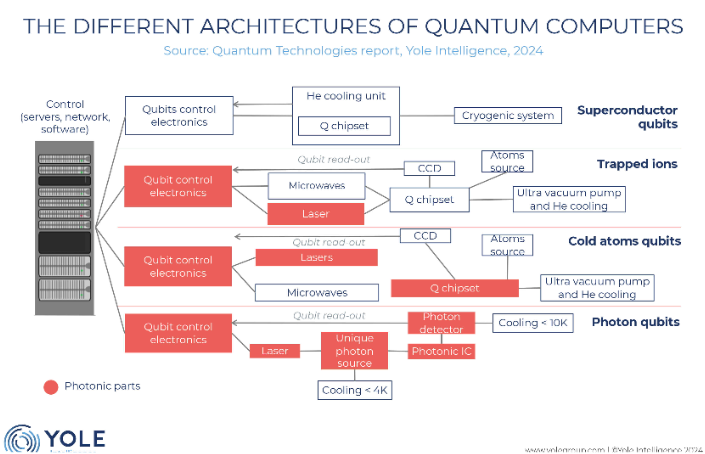

In this context, Yole Group launches its new dedicated report, "Quantum Technologies 2024." The 2024 edition provides detailed market data on quantum technologies, including computing, communication, and sensing/timing segments. It describes quantum technologies and related challenges. With this report, the market research and strategy consulting company analyzes major technological trends and enables a thorough understanding of the value chain, infrastructure, and players for quantum technologies and the quantum computing market.

The quantum ecosystem is advancing steadily, bolstered by collaborative research projects, patent accumulation, startup formation, and the entry of semiconductor vendors and equipment manufacturers into the fray. However, partnerships remain crucial as only a select few can simultaneously pursue diverse R&D approaches for qubits.

Investment in quantum technologies, both public and private, has reached significant levels, totaling $30 billion publicly and an estimated $4 billion privately thus far. Europe and the U.S. lead in quantum science investments, with the European Union being the largest public investor in quantum research. The U.S. benefits from substantial industry investments from tech giants like IBM, Google, Microsoft, and Intel, alongside a robust startup funding ecosystem, leveraging its domestic market size and dynamism. The majority of these funds, approximately 75%, are directed toward quantum computing hardware, given the substantial capital requirements for its advancement. The remainder primarily supports systems and applications software. Additionally, companies are transitioning from private financing to avenues like IPOs, mergers and acquisitions, and spin-off ventures. However, IPOs face challenges due to the absence of short-term revenue expectations in the quantum technology sector.

Looking ahead, the success of quantum computers hinges on addressing SWaP-C concerns. Despite the long-term nature of quantum technologies, investment opportunities are ripe today, particularly considering that technologies developed for quantum computing, such as photonics, cryogenics, RF, AP, and control electronics also hold promise in non-quantum computing applications.